Uncovering All the Secrets: Writee's Expenses Revealed!

June 16, 2023

June 16, 2023

As a student and an early-stage founder, managing money is among the most important things that I have to do daily to keep the company afloat. My co-founder and I couldn't afford to invest lakhs from our own pockets nor could we take investor money as it would've hampered our college life. We ended up investing Rs 10,000 ($122) each to get the business up and running. While it might seem like a meager amount of money, this was the only way that we could keep our business afloat at the time. The importance of being aware of all expenses when it comes to running a business cannot be overstated.

To help entrepreneurs stay on top of their finances, I am revealing a comprehensive list of Writee's expenses, which includes everything from government fees, founder compensation, and taxes to legal fees, marketing costs, and employee expenses. This important data provides crucial insights into where and how each rupee is spent, which can be invaluable in helping entrepreneurs make informed financial decisions. Armed with this information, entrepreneurs can now reduce wasteful spending, improve efficiency and invest more strategically.

Writee's expenses also demonstrate how a comparatively leaner ship can both save money and deliver results. This approach with its negatives, has resulted in the development of a full-fledged product that is focused on the customer first, propelling the business towards success.

I started Writee — an AI writing assistant — in my second year of college, which has enabled me to pursue my interests and experiences in tech, business, and entrepreneurship. Having bootstrapped the business and I've had to do most of the work myself, from product management and design to marketing and customer service.

I started Writee to help entrepreneurs with their writing. I wanted to create a tool that not only saves them time but also produces high-quality, well-written content better than they could produce themselves. I believe that Writee’s AI-driven platform is a valuable resource for entrepreneurs and businesses who are looking to stay ahead of the competition.

To give back to the community I decided to reveal all of Writee's expenses and explain how much money we spent and where it went.

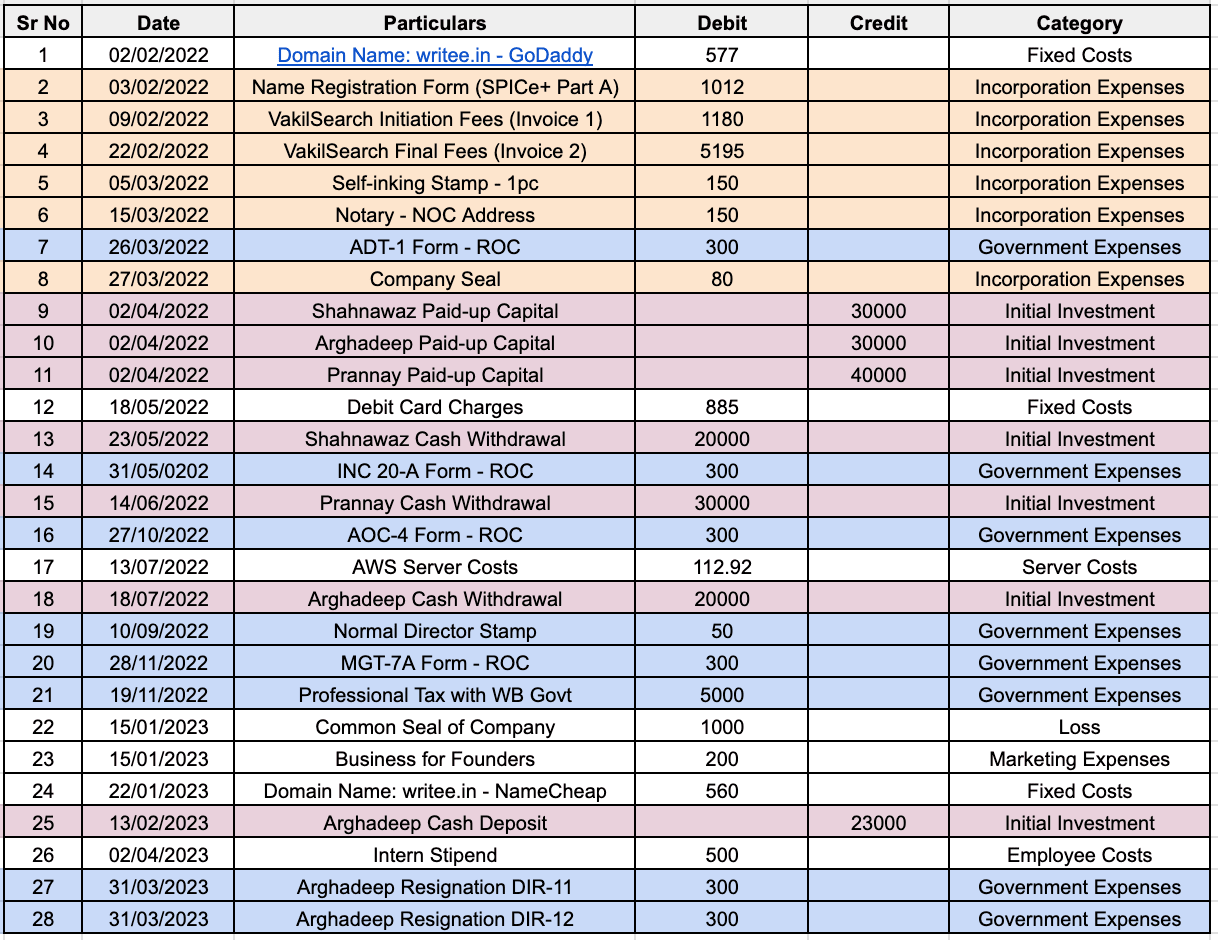

Here are all the expenses borne by Writee in its year of existence:

You'll observe that the line items can be broadly classified into 5 broad headings. I'll list them out first and then discuss them in-depth individually:

This is the initial cost to incorporate the company. According to Investopedia -incorporation describes a business registered with the government to become a separate legal entity. So, to officially call yourself a business, you need to register your identity with the government. There are many different structures you can choose to go with like LLP or Proprietorship etc. At Writee, we decided to go with a Private Limited Company. You can find more about registering your first company here.

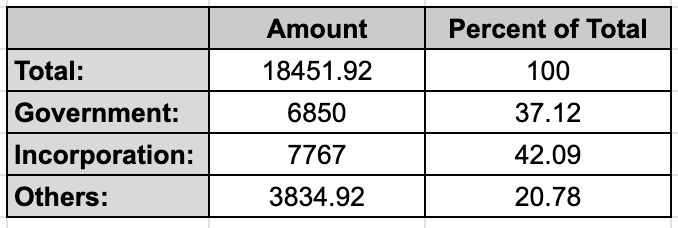

This is an expensive affair and we had to shell out Rs 7,767/- to get the process done. This is 42% of the total expenses incurred by Writee till 3rd April 2023. The main headings under this expense were:

At Writee, we've spent Rs 6,850/- in government expenses in the last year of operation. These do not include the incorporation cost. This accounted for 37% of our total expenses. While incorporation charges are unavoidable, they are a one-time payment. Government expenses are recurring payments, like filing fees, taxes, and various other fees required to run a business. Here is a list of all the government expenses we incurred in the last year of operation:

Along with these, you will in all probability have to pay Chartered Accountants hefty fees for facilitating the process. It will be a major expense you will have to incur. We were lucky in this regard. Our CA is an old family friend of mine and has seen me grow up. In honour of our longstanding relationship, he agreed to defer his fees till the time we start seeing returns on our business. In any case, this is one expense that every new entrepreneur has to incur and so, could not be avoided.

On close observation, you will notice that there are a lot of big transactions under this head. This is also the most interesting head of them all. Let me start by introducing to 2 terms - authorised capital and paid-up capital:

With a basic understanding of these two terms, I'll explain the initial investment section. According to the law, it is necessary to transfer the amount equal to the paid-up capital to the company's bank account. This signifies the completion of the sale of shares of the company. Given that we were students, we didn't have Rs 1,00,000 to put into a venture that was so risky. But we were bound by government regulations. To circumvent this, we decided to get a loan from our parents and put in Rs 10,000 each from our own pockets to run the company. Thus the transaction shows an inflow of Rs 1 lakh and an outflow of Rs 70,000 in cash. According to our books, the company has Rs 70,000 in cash which we either need to spend for the company or put back in the company's bank account at some point.

The interesting part is the Rs 23,000 which was deposited in the bank account by Arghadeep Sadhu. He was our third co-founder, who had resigned due to personal reasons. He now had to give back the amount of paid-up capital he had taken out in cash. His Rs 10,000 was already in the bank account, thus he had to deposit Rs 23,000 to make a total contribution of Rs 33,000 which was the value of the shares he bought during incorporation. My co-founder and I bought out his shares of the company and gave him an exit but those are transactions the company is bothered with.

After going through literally every transaction at Writee you'll realise that we are running a very lean ship. We operate at almost ZERO operational costs and have developed the entire product and market in-house through various benefits offered by the government. It is this frugality that allows us to sustain our business without having to rely on external funding through this tumultuous time in the content industry. The focus on operational costs has enabled us to stay agile, be creative and experiment with new product offerings or business strategies and reposition our offerings based on current market conditions.

This obsession with near-zero costs has its downsides too - it means we must live with more limited resources and that creativity is often limited by what is available, it curtails us from making larger beneficial investments that could potentially take the business to the next level. I do not suggest businesses follow our approach to business building. Instead, I advise you to imbibe the principles of frugality and a laser-sharp focus on cost reduction to make your business sustainable to a great extent antifragile. For any other questions on our expenses and my philosophy for making business decisions, please feel free to reach out to me here.