Primer on the use of AI in Early-Stage Venture Capital

September 12, 2024

September 12, 2024

The landscape of venture capital is evolving at a rapid pace. What was once an industry built on intuition, personal networks, and gut feelings is now being reshaped by data and automation. As competition intensifies, firms become indistinguishable and access to information is democratised, the VCs who will succeed are those who can move faster, spot opportunities earlier, and eliminate the inherent biases in human decision-making.

This primer is the result of my vicarious learning through interactions with multiple VCs about their deal lifecycles. There are a number of points in this primer that are highly debatable and can spark a lot of interesting debates which I am always open to. The aim of this primer is to provide a broad and opinionated starting point for VCs to begin interactions around the use of AI and data in their operations for greater successes. Success in venture capital hinges on two key metrics: the ability to attract high-quality inbound investment opportunities and delivering superior returns to limited partners (LPs). Both are intricately linked—being the first choice for top founders leads to outlier deals, which in turn generates extraordinary returns. Thus, it is essential to do the following in the deal sourcing and analysis stage:

To that effect, AI can help a Venture Firm with the following:

While all of the following can initially be individual offerings to be used as and when required to save hundreds of man-hours every month, it’s true power can be harnessed when an entire workflow will be developed out of the individual stages of the deal pipeline. This system can be developed into a tech-first, AI-integrated CRM system for the VC Fund.

This system will help do the following:

The use of AI in venture capital is not novel. VCs have been trying to incorporate data, automation and AI into their workflows for a while with varied amounts of success. Here are some of the most successful examples of how the following VC are using AI in their workflows:

This concept note discusses the possibility of an AI-powered co-pilot system to assist investors in sourcing and evaluating early-stage startup investments. The goal is to discover investable deals before the market, minimise decision-making biases while maximising financial returns. Common biases that can adversely impact investment decisions include selection bias, historical bias, representativeness heuristic, herd mentality, and anchoring bias. To maximise returns, the system would analyse factors such as founder investability, industry valuation multiples, revenue growth potential, and expected timelines to liquidity events.

The proposed system would have capabilities to create buyer personas, analyse market size, assess problem intensity, evaluate founder-market fit, benchmark key performance indicators, predict founder fundability, model exit opportunities, and present easy-to-understand business models. This would be achieved through an ensemble of technologies including fine-tuned language models, search engine APIs, web scraping, and databases.

After several rounds of iterative training on startup investment data, the system could potentially take on an AI venture capitalist role of not just assisting but actually leading investment decisions. While the human element can never be and should not be fully eliminated, this co-pilot could significantly augment human investors via rigorous quantitative and qualitative deal analysis.

Develop a co-pilot for early-stage VC Investors that discover companies before the market does and evaluates investments to minimise bias and maximise returns. We won’t discuss the obvious CRM features such as transcript uploads, meeting scheduling etc and limit our discussion to things that make the product a VC-centric AI CRM.

The metrics to optimise for are:

Sajith Pai of Blume Ventures once compared a VC to enterprise and like any sales jobs, VCs also have to jump through many hoops to develop a healthy, return-generating deal flow. The crude definition of deal flow is where the firm has start-ups to analyse for investments. There are broadly 2 form of deal flow:

While a VC often has a high volume of inbound opportunities, this doesn’t always translate to high quality opportunities. The opportunities with the possibility of outsized returns are either in very high demand, making the entire process extremely difficult or are completely under radar where most firms miss out on the opportunity.

Very evidently, this entire process is incredibly manual in the era of automated enterprise sales processes. Leads (aka opportunities) are not qualified objectively, too many people run behind too few deals leading to unjustifiable valuations and high quality leads are discovered incredibly late in their lifecycle. This entire process needs structure, efficiency and objectivity.

There are some common biases which creep into an investor’s analysis. Here’s a list of biases segregated according to the section of the investment memo it affects:

There are other biases which may be at play too, but for the sake of this discussion we’ll focus primarily on the one’s mentioned above.

Typically, there are 3 exit options for an pre-Series A investor:

An early investor doesn’t typically stay on the cap table till IPO, so the dynamics of public market valuations do not come into play. Even if they do, we can subsume the IPO case in the later stage investor case with the caveat that these later stage investors are in fact the retail investors.

To maximise returns, we need to maximise exit multiples while minimising time to exit. The metrics to analyse for this are the following:

The downside with this analysis is also where the upside lies. Most venture backed companies fail and very often the ones that succeed, break all traditional norms. An AI cannot model industry breaking successes - by very definition they are a black swan event. What this analysis will do is highlight all the red flags in a potential deal. All investment opportunities have inherent risks and it’s up to the investor to define their risk appetite.

One approach to solve this problem is to introduce a metric akin to beta or a risk factor in a later stage company. This can help quantify the risk of the investment even though we cannot quantify the upside potential.

To help investors maximise returns, the other approach to the problem would be to help inform the sell decision. Relatively lower number of companies falter massively post Series A which is a sweet spot to start doing quantitative and comp analysis. Since this is outside the scope of the problem statement, I’ll refrain from delving deeper into this.

In conclusion, this co-pilot can potentially help investors make fewer mistakes and gain average returns. The model will break down for industry-altering opportunities. Thus, it’s important to treat any opinions offered by the analysis with a pinch of salt if you’re looking to make outsized returns.

| Sr | Feature | Feature Description | Benefit |

| 1 | Pitch Deck Emails Centralisation | Every inbound email with a pitch deck is immediately added to the CRM | This can help systemise the pitch deck review process with the help of the evaluator in next step |

| 2 | LinkedIn Inbound Centralisation | Every member in the team will have access to a UI to add inbound requests on LinkedIn | Helps include visibility into inbound requests and reduces risk of overlooking a good opportunity |

| 3 | Tracxn, Crunchbase, Other Database trackers | Companies often voluntarily list themselves on a number of databases for multiple reasons. This is a gold mine for pre-seed and seed funds. Every new company added to these databases will be added to CRM | Helps automate discovery without having to go through the same steps in multiple databases daily |

| 4 | LinkedIn Scraper | We scrape LinkedIn for an unique queries to try and discover founders before they blow-up. This is typically useful only for pre-Seed and Seed funds. | Develop relationships with potential category leading founders before they start their journey |

| 5 | Twitter Scraper | While the start-up ecosystem is quite active on Twitter, its developer ecosystem is stronger. Very often these are people who are prone to starting up themselves and can be an incredible resource to find potential founders and even possibly nudge them into founding. | Develop relationships with potential category leading founders before they start their journey |

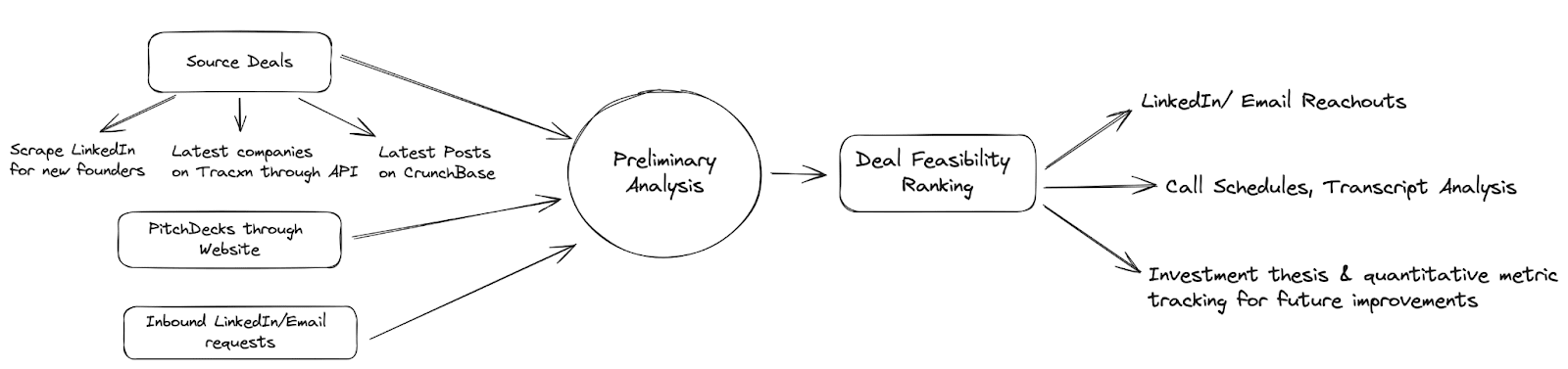

This is a primarily automated system that runs automatically and enriches the CRM system with data. For instances where the user needs to input data, there will be an easy-to-use form to add it.

| Sr | Feature | Feature Description | Benefit |

| 1 | Buyer Persona Creation | A descriptive buyer persona based on the business idea presented | Helps confirm the target market |

| 2 | Competition Search | List of competition in the niche, their monthly traffic, funding information | Helps judge the competitive landscape |

| 3 | Market Size Analysis | Broader target market analysis. For a company like Urban Clap, may not be able to narrow down to Tier-1/2 and instead calculate the market size of entire home service industry | Provides a ballpark figure to base calculations or judge mentioned market size |

| 4 | Problem Intensity Search | Use metrics like search volume, reddit threads and other proxy metrics to create a problem intensity score | Estimates the need of the solution in the market |

| 5 | Founder-Market Fit Check | Gains information on the founder from their work experience, LinkedIn, Twitter etc to assign a founder market fit score | Judges the founder's know-how in the market |

| 6 | Comp KPI Analysis | Comparative analysis of industry/ segment specific metrics for a company such as DAU, MAU, Churn etc | Provides a comparative positioning of a company w.r.t other successful players in similar industries |

| 7 | Founder Investability | A score to judge the investability of the founder based on metrics such as work ex, university, cap table | Helps judge potential exit opportunities |

| 8 | Exit Analysis | Analyses exits in similar spaces, venture capital funds that invest in the niche | Helps gauge exit opportunities and feasibility |

| 9 | Valuation Multiples | Typical valuation multiples that a company in the particular space gets | Back-of-the hand estimates for potential upsides |

| 10 | Business Model Presentation | A simple and clear presentation of the business model, clearly mentioning the cost drivers and revenue sources | Easy understanding of the business model and potential pitfalls |

Since ChatGPT, chat interfaces have become the norm for any type of co-pilot. This puts the onus of asking the right questions on the user, thus I do not prefer a chat interface for most use cases. In my conception of this co-pilot, we’ll generate an analysis for each business and provide the above data in the form of either an investment memo or a standard analysis to the user.

While I believe it’s better for the user to go through this in the form of an investment memo or analysis created by the AI, users will demand a chat interface with which they can interact. This can be achieved using a simple chatbot with a basic information retrieval system.

The integration of AI into a VC firm's operations would represent a paradigm shift in how the firm sources, evaluates, and manages investments. By automating and enhancing various stages of the investment process, AI tools can significantly boost the efficiency and effectiveness of the firm. To reach its full potential, we need to make the product described above much more robust but this is more than sufficient for a v1.

Firstly, AI aids in deal sourcing by continually collecting data from platforms like Tracxn, Crunchbase, and LinkedIn, ensuring that the firm is among the first to identify promising startups. This proactive approach enables the firm to discover and engage with high-potential founders before their competitors, thus securing better investment opportunities.

Secondly, AI-powered ranking systems streamline the evaluation of pitches, enabling faster sorting and response times. By scoring companies based on proprietary metrics, AI helps prioritise the most investable startups, ensuring that valuable time is spent on the most promising opportunities.

Furthermore, AI contributes to detailed preliminary analysis, including competitor research and buyer persona creation, saving hundreds of man-hours. This allows the firm to focus more on supporting their portfolio companies, ultimately driving outsized returns.

Globally, leading firms like EQT Ventures, Signalfire, and Hone Capital demonstrate the tangible benefits of AI in VC. EQT's Motherbrain, Signalfire's Beacon, and Hone Capital's machine-learning model showcase how AI can enhance deal origination, investment decision-making, and portfolio support. These firms leverage AI to maintain a competitive edge by identifying trends, benchmarking performance, and providing real-time insights, which are crucial for informed investment decisions.

After 3-5 years of iterative training, I believe this model has the ability to eventually move towards an AI-Venture Capitalist model. Inventus Capital has been envisioning something of this form but hasn’t shown any concrete results yet. Instead of Inventus Capital’s goal of replacing human VCs, I believe this tool can reduce the number of analysts required by a firm for memo writing etc. All of the grunt work can be outsourced to the AI while the investment managers work on the softer aspects of understanding and predicting human behaviour.

If this intrigues you and you want to deep dive into the various aspects of this CRM, I’d love to talk. You can reach out to me here or hit me up at prannaykedia1@gmail.com.